do nonprofits pay taxes in canada

Distinguishing a non-profit organization from a charity. It is not necessary to pay property taxes to get nonprofit services from local governments.

Employees with higher responsibilities or those in supervisory roles typically earn more.

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)

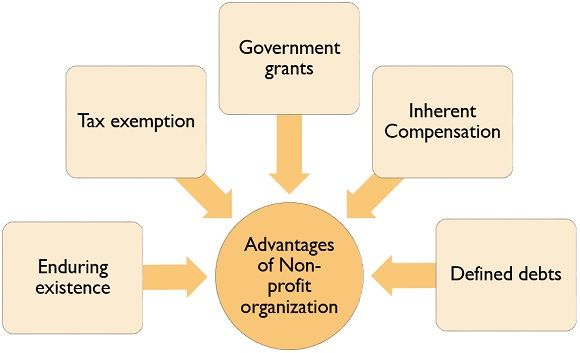

. Are nonprofit organizations tax exempt in Canada. Nonprofit tax filing requirements vary based on the type of organization the value of the organizations assets and other factors. Any nonprofit that hires employees will also.

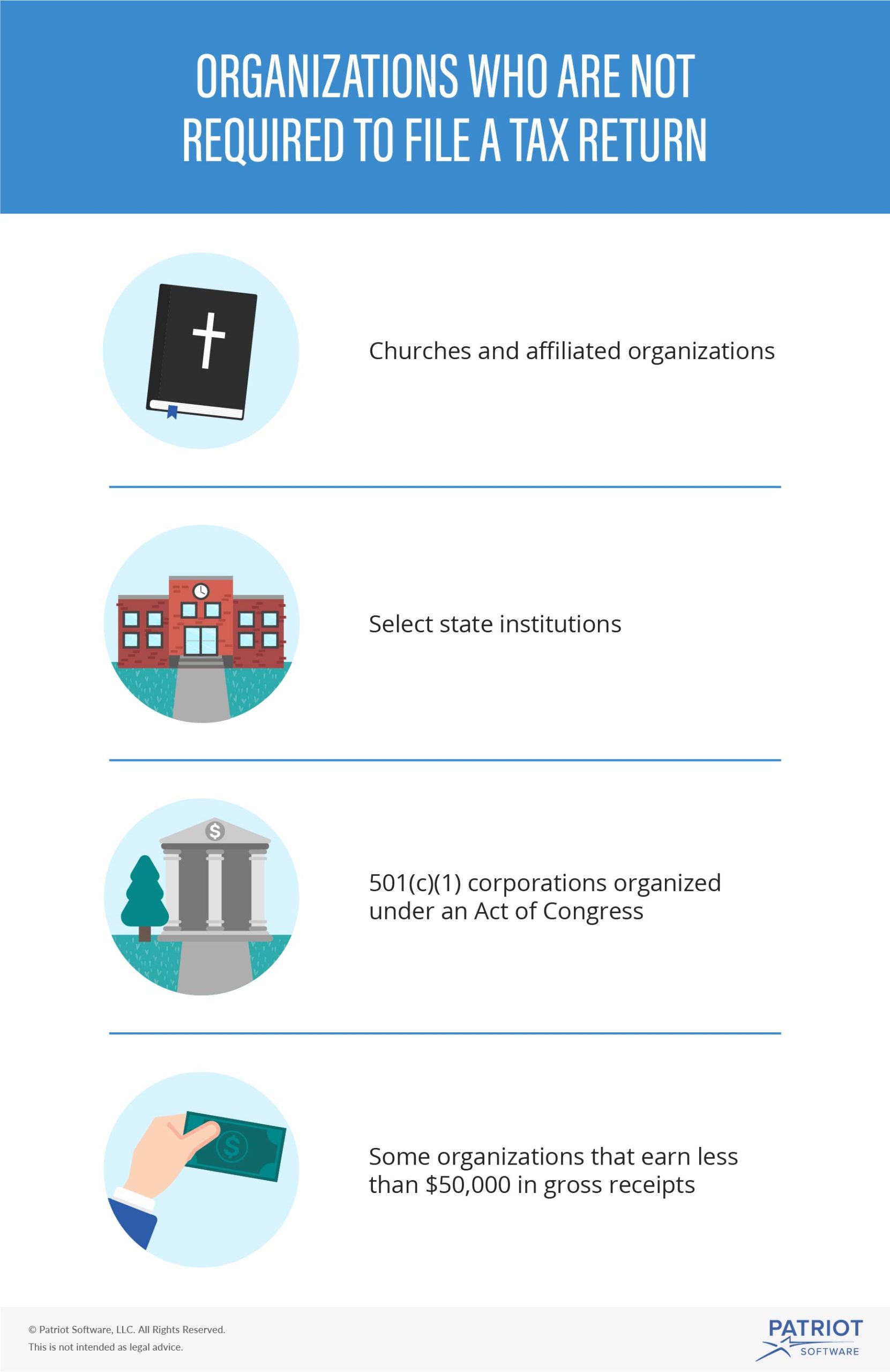

Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada Revenue Agency. Not-for-profit corporations are not automatically considered registered charities or non-profit organizations for income tax purposes. NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization Information Return.

Income Tax Exemption and Tax Treatment of Donations. Do nonprofits pay taxes in canada Tuesday February 22 2022 Edit. For instance education and health-related nonprofit organizations tend to pay higher salaries.

Charities and not-for-profits ought to ask themselves whether property taxes apply to them in light of this. A person not resident in Canada is liable for tax on any income earned from a Canadian source. The CRA bans both of these organizations from using their income to benefit members.

Specific types of nonprofits offer more competitive wages. Nonprofit organizations are exempt from federal income taxes under subsection 501 c of the Internal Revenue Service IRS tax code. Thus in order to be liable to pay tax an Association must be a person for income tax purposes.

For the most part nonprofits are exempt from most individual and corporate taxes. What taxes do nonprofits pay. We tend to think that the government grants tax exemptions to charities and tax credits for donations to same because its.

Liability to pay tax The Act generally requires that every person resident in Canada pay tax on their world-wide income. Once accepted a registered charity is exempt from income tax under paragraph 1491f. Nonprofits are also exempt from paying sales tax and property tax.

Under the Act a charity can apply to the Canada Revenue Agency for registration. Duties and Responsibilities Involved. NPOs and registered charities are not subject to income tax.

If your NPO has received or is eligible to receive taxable dividends interest rent or royalties worth more than 10000 you. Additionally Canada recognizes a statutory list of organizations which are not technically charities but which are treated as such for the purpose of. Do Non-Profit Organizations Pay Tax.

For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount. This exemption applies only to income tax. Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada Revenue Agency.

Not-for-profits that are registered charities must file an income statement annually to the Canada Revenue Agency. Both charities and nonprofit organizations do not have to pay income tax. Do non profits pay taxes in Canada.

Nonprofit tax filing requirements vary based on the type of organization the value of the organizations assets and other factors. Tax time can be stressful for nonprofit and charitable organizations in Canada especially when the filing requirements are not well understood within the organization. Neither exempt from income tax nor from property tax under the Income Tax Act Canada contrary to what appears to be the intention charitable and non-profit organizations often face heavy financial penalties associated with property taxes.

Even though not-for-profits dont pay income tax the requirement to file a tax return has been in place since 1993 and penalties exist for late filing. An NPO cannot be a charity as defined in the Income Tax Act. While the income of a nonprofit organization may not be subject to.

Nonprofits are of course not exempt from withholding payroll taxes for employees and they also are required to pay taxes on income from activities that are unrelated to their mission. In Canada our tax policy for charities actually confuses the understanding about the tax treatment of churches. Not-for-profits generally do not pay corporate income tax or file an Ontario corporate tax return but they do have to meet some requirements under Canadas Income Tax Act.

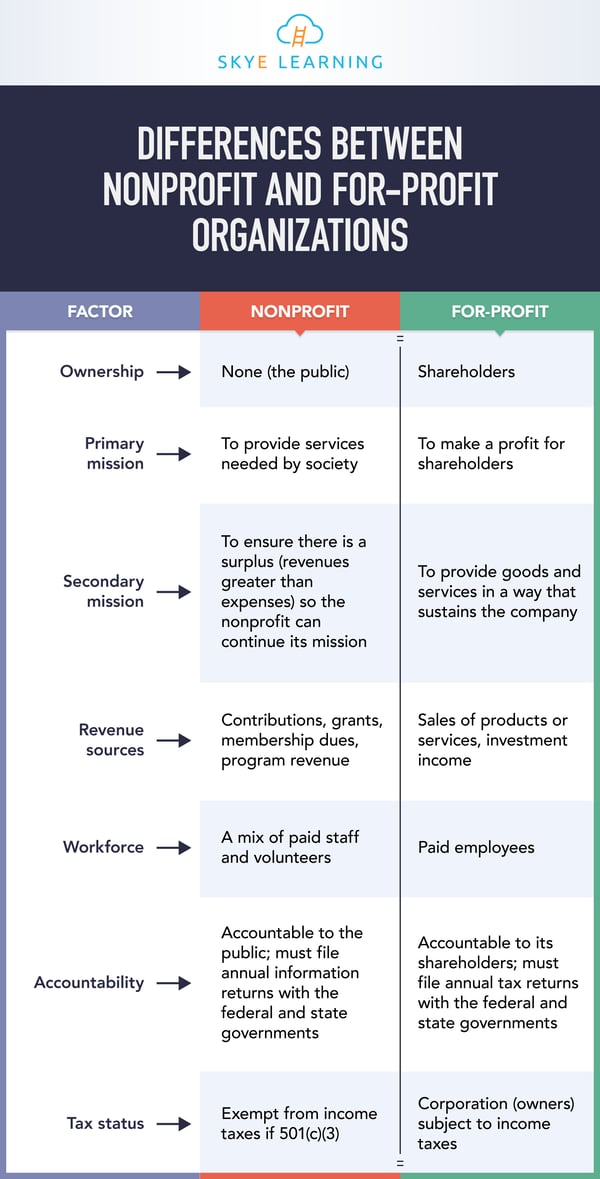

There are differences between these types of organizations. All nonprofits are exempt from federal corporate income taxes. Non-profit organizations are exempt from tax under Part 1 of the Income Tax Act for the portion of their fiscal period where they meet the requirements to qualify as a non-profit organization.

Most are also exempt from state and local property and sales taxes. Pin On Infographics Pin On Luxe Accounting Tax Services What Are The Private Public And Nonprofit Sectors And Which One Is Right For You Ie School Of Global Public Affairs. Because nonprofits are tax exempt homeowners and for-profit businesses are taxed as if they are helping them provide nonprofit organizations with benefits such as streetlights and police.

There are certain circumstances however they may need to make payments. Which Taxes Might a Nonprofit Pay. Not-for-profit corporations therefore are not necessarily exempt from paying regular corporate taxes under the Income Tax Act.

The CRA bans both of these organizations from using their income to benefit members. Both charities and nonprofit organizations do not have to pay income tax.

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

What Is A Non Profit Corporation Types And Purposes

The Top 8 Seo Tips For Nonprofits Who Want To Rank 1 Nonprofit Marketing Ideas Non Profit Seo Tips

What Is A Nonprofit Definition And Types Of Nonprofits 2022 Shopify New Zealand

Can A Nonprofit Charge For Its Services Transform Consulting Group

Canadian Nonprofits Claim Government Targets Muslim Charities The Nonprofit Times

Maine Budget Proposal Includes Controversial Tax Changes For Large Nonprofits Canadian Call Centre Ivr Web Chat And E Mail Response Solutions Fun Fundraisers Nonprofit Fundraising Non Profit

Main Purpose Of A Nonprofit Organization Ngo Goals

Non Profit Vs Not For Profit What S The Difference 2022 Shopify New Zealand

What Is A Non Profit Corporation Types And Purposes

Do Nonprofits File Tax Returns If They Re Tax Exempt

Do Nonprofits File Tax Returns If They Re Tax Exempt

Complete Guide To Donation Receipts For Nonprofits

What Is A Non Profit Corporation Types And Purposes

Do Nonprofits Register For A Tax Id In Canada Ictsd Org

What Type Of Corporation Is A Nonprofit Fundsnet

7 Differences Between Nonprofit And For Profit Organizations